How to Properly Calculate Consumer Surplus in 2025 for Better Economic Insights

How to Properly Calculate Consumer Surplus in 2025 for Better Economic Insights

Understanding the Definition of Consumer Surplus

Consumer surplus is a fundamental concept in welfare economics, reflecting the difference between what consumers are willing to pay and what they actually pay. In simple terms, it represents the benefit consumers receive when they purchase a product for less than the maximum price they would be willing to pay. To accurately measure consumer surplus, we need to grasp the underlying principles, including the relationship between price changes, consumer decisions, and the overall demand curve. By analyzing these factors, economists can assess how well markets function and the efficiency of resource allocation, thus providing valuable insights into economic welfare.

The Consumer Surplus Formula

The primary formula for calculating consumer surplus involves finding the area above the equilibrium price and below the demand curve. The formula can be represented as follows: Consumer Surplus = 0.5 × (Base × Height). Here, the base is the quantity of goods sold while the height is the difference between the willingness to pay (represented by the demand curve) and the market price. For example, if a consumer is willing to pay $50 for a product but buys it for $30, their individual consumer surplus would be $20. Aggregating these surpluses for all consumers helps evaluate the total economic surplus available in the market, essential for policymakers aiming to understand economic welfare and market efficiency.

Graphing Consumer Surplus for Visualization

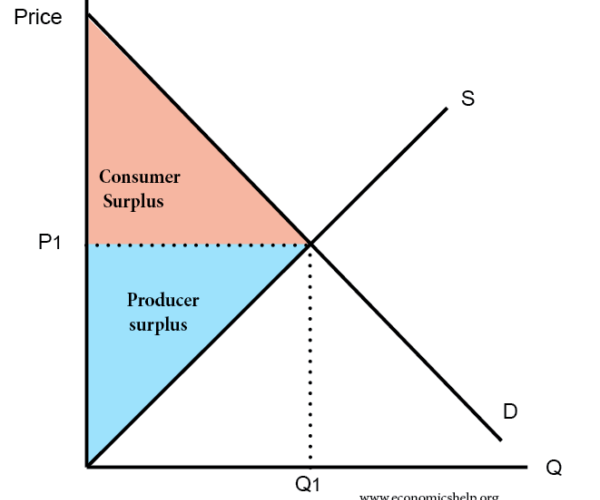

Visual representations can greatly enhance one’s understanding of consumer surplus. A typical consumer surplus graph depicts the demand curve sloping downward with the price on the vertical axis and quantity on the horizontal axis. The area between the demand curve and the price level defines the consumer surplus. This graphical representation not only aids in visualizing consumer behavior and preferences but also highlights shifts that occur in response to price changes. By observing these shifts, we can infer how various factors, such as income levels or price ceilings, impact consumer welfare and demand fluctuations, further facilitating surplus analysis in various market scenarios.

Measuring Consumer Surplus in Practice

Measuring consumer surplus goes beyond mere calculation; it requires a comprehensive understanding of market dynamics, demand elasticity, and consumer preferences. A critical approach involves evaluating how changes in price or economic shocks affect consumer demand. For instance, when prices drop due to increased supply, the subsequent rise in consumer demand frequently leads to a larger consumer surplus. Economists often utilize price elasticity of demand to understand how sensitive consumers are to price changes, allowing for a more accurate impact assessment on overall consumer welfare and market efficiency.

Practical Consumer Surplus Examples

By examining real-world scenarios, we can better understand consumer surplus. Consider a scenario where a favorite game is released at a price of $40, while the consumer value it at $70. This generates a consumer surplus of $30. Conversely, if the game’s price increases to $50, we observe a decrease in consumer surplus, reflecting both demand response and prices’ critical role in consumer behavior analysis. Thus, understanding individual consumer preferences and their economic implications can guide businesses in pricing strategies and inventory decisions.

Exploring Consumer Surplus Adjustments

Price changes can lead to significant adjustments in consumer surplus. A rise in prices, for instance, typically reduces consumer surplus as fewer consumers are willing to pay those elevated prices, leading to decreased total demand. This adjustment can also reflect various fiscal policy effects and market interventions, with resulting implications for overall economic dynamics and purchasing behaviors. By tracking historical consumer surplus changes due to price fluctuations, policymakers can devise effective strategies to encourage or mitigate such changes to optimize market conditions.

The Impact of Price Changes on Consumer Surplus

Understanding how price changes instigate shifts in consumer surplus is crucial for effective economic analysis. When prices decrease, the consumer surplus generally increases, as more consumers can afford the product, effectively elevating consumer welfare. However, there are scenarios—such as price ceilings enforced by legislative measures—that can distort typical consumption patterns and alter overall market efficiency. By analyzing these cases, one can spark discussions on substitution effects and consumer behavior modifications prompted by external factors.

The Price and Demand Relationship

The relationship between price changes and consumer demand directly shapes the consumer surplus landscape. A common illustration of this is depicted in elasticity of demand—wherein some products exhibit greater responsiveness to price changes than others. As consumer preferences determine how demand attracts certain prices, it’s imperative to comprehend this interplay when estimating consumer surplus changes over time. Understanding this relationship not only aids in analyzing past market behavior but also equips businesses with foresight on predicted consumer reactions to future price policies.

Challenges in Measuring Surplus

Despite the theoretical clarity of the consumer surplus concept, practical measurements can face significant challenges. For instance, variations in consumer preferences, external economic factors, and imperfections in the market (like monopolies or oligopolies) can skew consumer surplus estimates. Effective consumer behavior analysis thus requires incorporating broader data analyses and consideration of external factors that influence demand. Understanding these complexities promotes a holistic view of consumer surplus, enabling regulators and economists to appreciate welfare implications and guiding effective market interventions on crucial issues.

Key Takeaways on Consumer Surplus Calculations

To conclusively grasp consumer surplus, here are essential takeaways: 1) Consumer surplus, defined as the difference between what consumers are willing to pay and the price they pay, is paramount for assessing market efficiency and consumer welfare. 2) The consumer surplus formula involves the area below the demand curve and above the equilibrium price, illustrating total surplus in the market. 3) It’s crucial to consider price changes and their impacts on demand and surplus through elasticity analysis, providing invaluable insights into pricing strategies. 4) Recognizing adjustments and measuring challenges fosters a thorough understanding, aiding businesses and policymakers alike in optimizing their economic strategies, ensuring better welfare outcomes.

FAQ

1. What are the implications of consumer surplus vs producer surplus?

The distinction between consumer surplus and producer surplus helps illustrate the overall economic wellbeing within a market. While consumer surplus focuses on the benefits consumers receive from purchasing goods at lower prices than they’re willing to pay, producer surplus measures the advantages sellers gain when they sell goods at a price higher than their minimum acceptable price. Understanding the balance of these surpluses is essential for evaluating total economic welfare and market efficiency.

2. How does price discrimination affect consumer surplus?

Price discrimination can significantly influence consumer surplus. In cases where different consumers pay varying prices for the same product, price discrimination maximizes producer surplus at the expense of consumer surplus by extracting more economic value from consumers willing to pay more. However, when strategized correctly, it can also enhance consumer welfare by providing access through lower prices to specific consumer segments, fundamentally altering traditional surplus evaluations.

3. What are the effects of pricing on consumer decisions?

Pricing directly impacts consumer decisions and behaviors, governing demand curves. Changes in prices can lead to varying demand levels, especially among elastic goods where consumers respond prominently to cost changes. As we develop pricing strategies, being aware of the price elasticity assists in optimizing profit margins while maximizing consumer surplus, ultimately stimulating a more efficient marketplace.

4. What role does marginal utility theory play in understanding consumer surplus?

The marginal utility theory assists in comprehending how additional satisfaction or utility derived from purchasing products influences consumer surplus. As consumers make purchasing decisions based on their perceived utility, firms can enhance their offerings to align with these preferences, maximizing their potential consumer surplus. By aligning products with high utility levels, businesses can attract consumers while providing value.

5. How do market equilibrium conditions impact consumer surplus?

Market equilibrium represents a state where supply equals demand. At this point, consumer surplus is maximized, as purchases occur at prices that represent the actual intersection of demand and supply. However, disturbances such as shifts in supply or demand—often caused by economic shocks or policy changes—can shift this equilibrium, leading to fluctuations in consumer surplus. Understanding these dynamics allows economists to assess the stability and efficiency of markets.