Best 5 Effective Ways to Build Business Credit in 2025: Improve Your Financial Standing

“`html

Best 5 Effective Ways to Build Business Credit in 2025: Improve Your Financial Standing

In today’s competitive landscape, establishing robust business credit is crucial for any entrepreneur aiming to secure funding and enhance their financial standing. As we enter 2025, the methods of building and improving business credit continue to evolve. Below, we explore the most effective strategies to help you successfully build business credit and navigate your financial journey.

Understanding Business Credit Scores

Before diving into the techniques for building credit, it’s essential to grasp the fundamentals of business credit scores. Unlike personal credit scores, which range from 300 to 850, business credit scores usually range between 0 to 100, with a score above 80 considered favorable. Major agencies, such as Dun & Bradstreet (D&B), Experian, and Equifax, evaluate your business credit history, payment practices, and overall financial behavior to determine your score.

Factors Influencing Business Credit Scores

Understanding the factors that affect your business credit score is vital for effective credit management. The key elements include payment history, debt utilization, credit history length, and types of credit accounts. Establishing a strong payment history by consistently meeting deadlines, along with maintaining a low debt utilization ratio, can significantly enhance your score. Additionally, regularly monitoring your business credit report for discrepancies provides insight into areas for improvement.

Importance of Business Credit vs Personal Credit

The distinction between business credit and personal credit is crucial for aspiring entrepreneurs. Utilizing business credit can help you separate your personal financial responsibilities from your business operations, protecting your personal assets from business liabilities. Moreover, a solid business credit rating improves your chances of securing beneficial financing arrangements without the need for a personal guarantee.

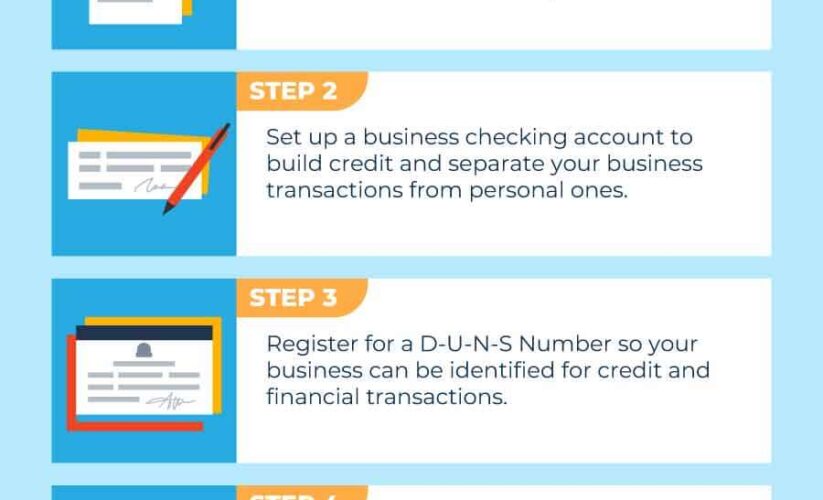

Steps to Establish Business Credit

Establishing business credit is a multi-step process that builds your credibility in the eyes of lenders. Following the right steps will significantly improve your business credit history and make you a more attractive candidate for financing.

Step 1: Form a Legal Business Entity

One of the foundational steps to build business credit is to establish a legal business entity, such as an LLC or corporation. This legal structure not only protects your personal assets but also allows your business to function as a separate financial entity. As a result, it becomes eligible to apply for business loans and credit cards without personal liability.

Step 2: Obtain a Federal Employer Identification Number (EIN)

To further establish business credit, it’s important to obtain an EIN from the IRS. This unique identifier is crucial for opening business accounts, applying for loans, and building relationships with credit bureaus. It confirms that your company has a valid tax identity separate from your personal finances, enhancing your business creditworthiness.

Step 3: Open Business Bank Accounts

Opening dedicated business bank accounts allows you to manage your cash flow effectively while establishing a tangible record of your company’s finances. Ensure all transactions, including income and expenses linked to your business credit, are conducted through these accounts to build a trustworthy business credit profile. This step is critical for lenders evaluating your business credit application.

Effective Business Credit Strategies

Once you establish a credit profile, consistent application of smart strategies is essential for maintaining and improving your business credit. Here are some practical techniques you can utilize.

Utilize Vendor Credit

A smart way to leverage business credit is through vendor credit lines. Many suppliers offer credit terms to businesses that allow purchases without immediate payment, which can enhance cash flow. Make sure to choose suppliers that report to credit bureaus to ensure that your timely payments positively influence your business credit scores.

Secure Business Credit Cards

With a solid foundation established, acquiring business credit cards can significantly improve your credit history while offering cash flow flexibility. Opt for cards with favorable terms and those reporting to credit agencies. This allows every responsible payment you make to act as a factor that bolsters your creditworthiness.

Monitoring Business Credit

To safeguard and enhance your business credit, consider employing business credit monitoring services. These tools will alert you to any changes or issues with your business credit report, allowing you to address potential concerns proactively. Continuous monitoring helps in maintaining a transparent and healthy business credit history.

Key Takeaways

- Understanding the nuances of business credit scores is imperative for building a positive credit history.

- Establish a legal entity and acquire an EIN to secure business credit and separate your personal finances.

- Open dedicated business bank accounts to reflect a trustworthy financial profile.

- Utilize vendor credit and business credit cards to effectively manage and improve your credit.

- Invest in business credit monitoring to stay informed about your credit status.

FAQ

1. What is the best way to improve business credit scores?

Improving your business credit scores involves several steps, including ensuring prompt payment to creditors, keeping a low ratio of credit utilization, regularly checking your business credit report for inaccuracies, and diversifying your credit accounts. By establishing these strong habits, entrepreneurs can gradually enhance their credit profile.

2. How does a legal business structure affect business credit?

Establishing a legal business structure, such as an LLC or corporation, is critical for accessing business credit. It separates personal from business finances, reducing personal liability and enabling the business to build its own credit history, which lenders look for in business loan evaluations.

3. What are some common misconceptions about business credit?

Many people believe that business credit operates the same as personal credit. However, business credit factors, reporting stenography, and scores differ significantly. For example, business credit does not include personal guarantees unless specified, which impacts credit risk assessments.

4. How can a small business quickly establish credit?

To quickly establish credit, focus on setting up a legal business entity, obtaining an EIN, opening a business bank account, and applying for business credit lines with vendors that report to credit bureaus. Timely payments on these accounts will build a positive credit profile.

5. What role do business credit monitoring services play?

Business credit monitoring services help track your business credit report, alerting you to any changes or potential inaccuracies. This allows for proactive management of your credit profile, an essential strategy for maintaining a robust business credit history.

“`